EazeMax Statutory Compliance Management Software for Professionals

Compliance describes the method required to follow the jurisdiction's tax laws and regulations. EazeMax compliance software supports taxpayers in fulfilling their tax compliance requirements.

Essential Elements of Compliance Manager Software

The compliance Manager is important for keeping the integrity of the tax system, which ensures that all the compliance pertinent documents and processes are completed at the internal management level so that no compliance problems remain unresolved.

Rapid Change In Statutory Law

Various regulatory laws and regulations are there that are amended frequently, which makes it unfeasible to track updates. Thus, it is important to have a system that ensures that individuals remain informed of such legal amendments.

Adherence to Laws

EazeMax software updates you about the actual changes occurred in the applicable regulations and ensures that no one misses any compliance due date, which saves them from any future penalty.

Main Challenges of Statutory Compliance for Businesses and Professionals

From intricate tax laws to ever-changing regulations and burdensome procedures, various issues exist in navigating tax compliance in India. Below are the encountered problems.

Complexity of Tax Laws

The tax system of India is multifaceted, containing income tax, Goods and Services Tax (GST), and various state-level taxes. Comprehending and adhering to these laws poses challenges for businesses and individuals.

Rapid Regulatory Changes

In India, the tax laws change frequently, which makes it difficult for taxpayers to stay ahead of the latest requirements and adjustments.

Tax Disputes and Litigation

For taxpayers and businesses, the disputes over taxes are widespread in India, which leads to delays and uncertainty.

Limited Awareness and Education

Taxpayers in India, specifically in rural areas and the informal sector, do not have awareness and understanding of their tax liabilities, which inadvertently leads to non-compliance.

Compliance Costs

Tax compliance expenses like hiring tax professionals and maintaining meticulous records can be important for businesses, especially small and medium enterprises (SMEs).

How EazeMax Can Become Your Best Compliance and Task Manager

EazeMax offers a comprehensive solution for compliance management, helping professionals and businesses handle complex regulatory requirements with ease. The software features a user-friendly interface and smart tools designed to simplify best statutory compliance software. With built-in virtual assistance and automated reminders, you’ll never miss important deadlines or statutory obligations. The software keeps you informed about upcoming compliance requirements and guides you through the submission process, ensuring accurate and timely compliance every time.

Get a free DemoExplained EazeMax Statutory Compliance Management Workflow

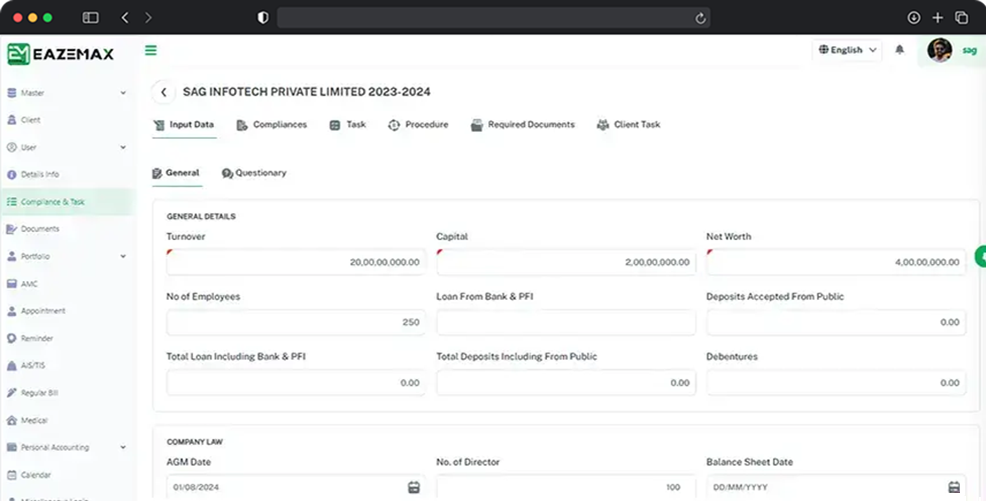

Compliance with Regulatory Requirements

EazeMax will analyse the data that you feed, like your turnover, capital, and net worth, and determine the compliance needs of your business, which covers areas such as GST, Income Tax Act, TDS, MCA, SEBI, PF, ESI, Bonus Act, etc. You will fulfil legal and regulatory standards through this.

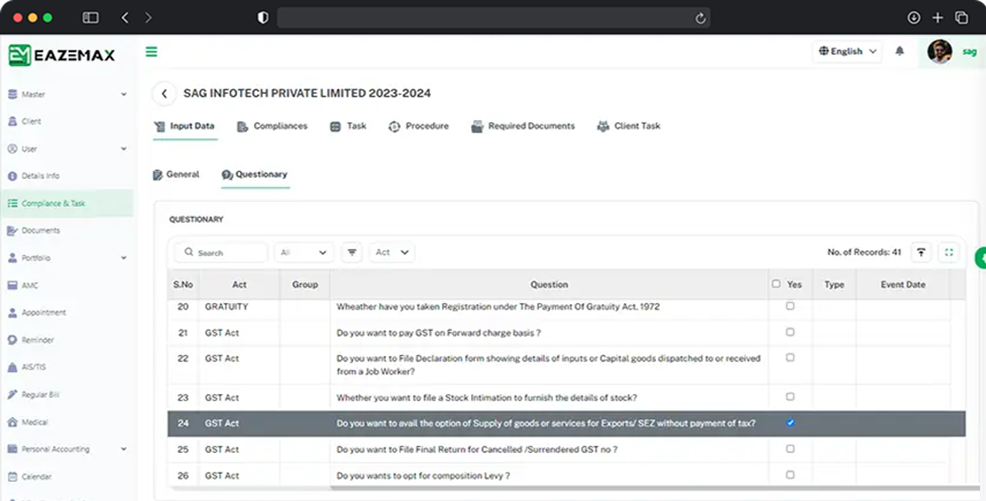

Checklist for Compliance with Event Regulations

Users for the event-related compliance choose the pertinent questions from our compliance checklist. It eases the identification of requirements based on the event or situation, making it simpler to address required compliance tasks.

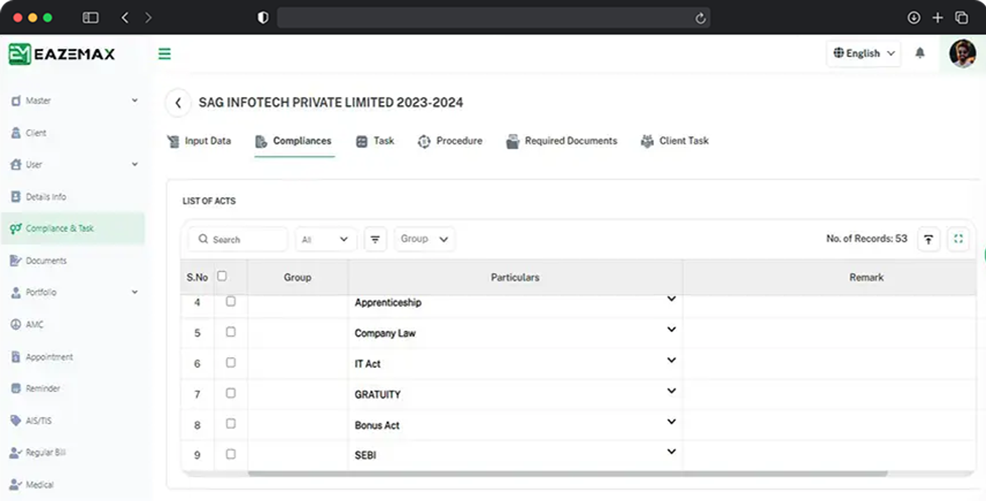

Compliance Details

The same sections specify the applicable compliances based on the selections incurred in both the general and questionnaire sections. It provides the users simpler access to their chosen compliance measures, which furnishes a facilitated approach to comply with the regulatory and other compulsory requirements.

Task Management Features

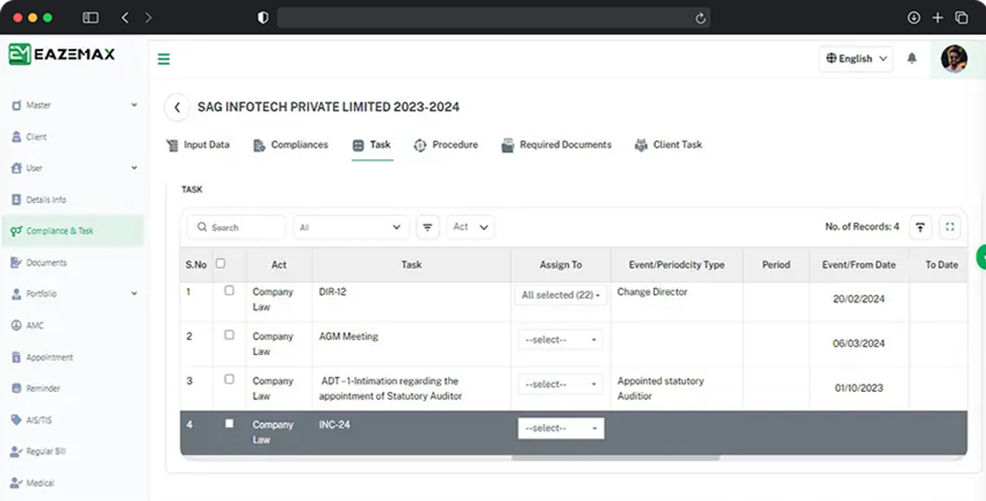

In the Task Tab, tasks are made based on the compliance selections made in the previous step and assigned to employees/users. It confirms that obligations are delegated, rectifying the efficiency and accountability in fulfilling compliance requirements.

Assignment of Procedures

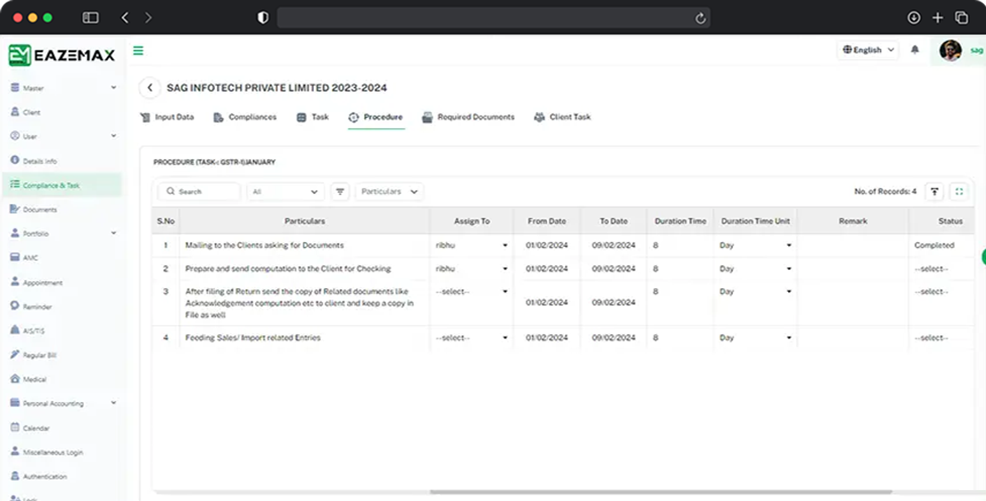

From the selected task, the "Procedure" tab auto-generates steps, enabling efficient assignment to employees/team members. Task delegation, workflow enhancement, and transparency improvement shall be facilitated in this automation. The same encourages collaboration, assures process adherence, and fosters operational efficiency while lessening errors across the team and facilitating compliance management.

Document Collection Technique

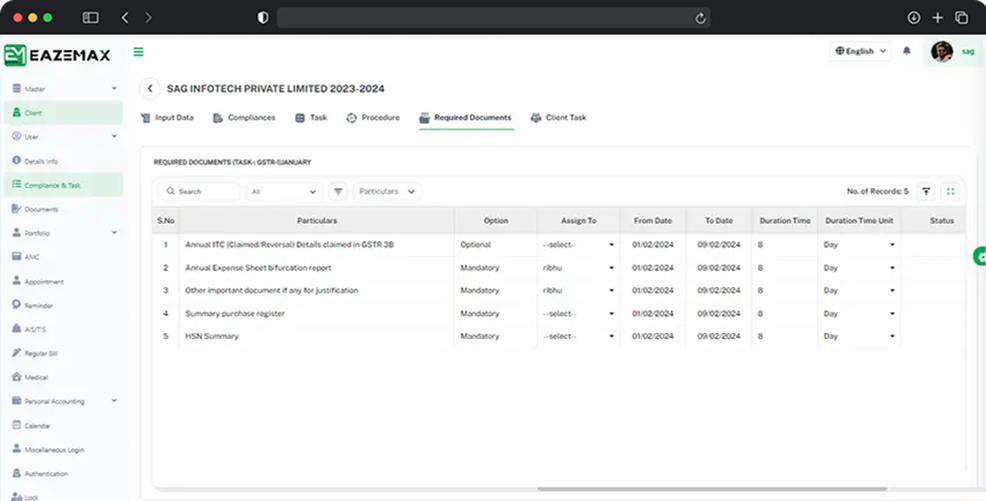

Both employees and users under the “Required Documents” tab are authorised to see the list of important documents and request any missing documents from the client side to finish the compliance task. The same tool optimises the process of document collection, which makes efficient communication and secure acquisition of all required documentation while streamlining compliance management.

Client Task Process

This step outlines all tasks related to the compliance requirement that the client must complete, along with the status of each task. Clients can easily track which tasks are pending and which have been completed, review essential steps, and manage relevant documentation. This section simplifies the compliance process, boosting clarity, efficiency, and improved organisation.

EazeMax Eased Statutory Compliance Management Software

The category also offers several excellent features to support the quick compliance and task management requirements, enabling outperformance in the last-minute rush for data input and compliance data. Given below are some notable features:

.jpg)